Frequently Asked Questions

For personalized advice and service details specific to your situation, we encourage you to reach out directly to our team of dedicated tax professionals.

What services does AWNAB Professional Services provide?

We offer a wide array of tax-related services, including tax preparation, tax planning, audit representation, and assistance with state and federal tax filings for both individuals and businesses.

Who can use our services?

Our services cater to individual taxpayers, businesses, and non-profit organizations that require assistance with their U.S. tax affairs, regardless of their location within the country.

How does the tax preparation process work at AWNAB Professional Services?

Our tax preparation process is designed to be smooth and efficient. After you schedule an appointment and provide the necessary documentation, our team of certified tax professionals will work to accurately prepare your tax returns, ensuring to capitalize on all applicable tax credits and deductions.

Can AWNAB Professional Services help with state tax filings?

Yes, we provide assistance with both federal and state tax filings, ensuring compliance with the specific tax laws and requirements of each U.S. state.

How much do your services cost?

Our pricing varies based on the complexity and type of service rendered. We are dedicated to maintaining transparency and will provide a detailed quote after understanding your specific needs during our initial consultation.

What payment methods do you accept?

We accept various payment methods, including credit/debit cards, bank transfers, and checks. Please contact us directly if you wish to discuss alternative payment arrangements.

How does AWNAB Professional Services ensure the safety and privacy of my data?

We prioritize your data security and employ rigorous data protection practices, including encryption and secure data storage. Our policies are designed to safeguard your information from unauthorized access and disclosure.

Do you offer virtual consultations and online services?

Yes, we offer online consultations and digital services to provide efficient tax assistance, no matter where you're located. Our secure online portal allows you to submit documents and communicate with our team virtually.

What types of communication and updates will I receive?

Our clients receive personalized communications, including tax tips, e-books, video courses, and occasional promotional offers. We ensure all communications are insightful and relevant to your tax situation.

How can I get assistance with tax planning and legal tax advice?

Our team of tax experts is here to help with tax planning strategies and legal tax advice to optimize your tax position and ensure compliance. Schedule a consultation with us to discuss your specific tax situation.

Let's Chat About Your Dollars and Cents

We’re here to put all those financial puzzles together for you. Eager to untangle those financial knots? Let's chat!

George Owens

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Quisque nisi nunc, tincidunt non nibh non, ullamcorper facilisis lectus. Sed accumsan metus viverra turpis faucibus, id elementum tellus

Max Tanner

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Quisque nisi nunc, tincidunt non nibh non, ullamcorper facilisis lectus. Sed accumsan metus viverra turpis faucibus, id elementum tellus

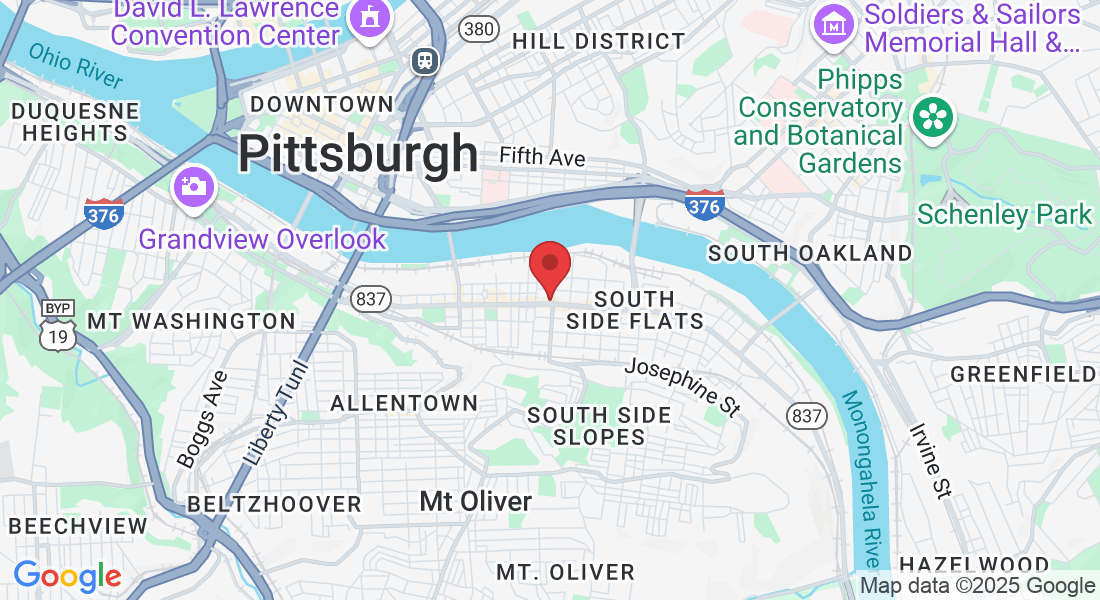

AWNAB Professional Services

1735 E. Carson Street, STE 314, Pittsburgh PA 15203,Pittsburgh

info@awnabproservices.com

(878) 231-3932

© Copyright 2026 AWNAB Professional Services

All Rights Reserved